Table of Contents

Toggle

Are you a business owner in search of the perfect accounting software to streamline your financial processes? Look no further! In “The Ultimate Guide to Finding and Comparing Business Accounting Software”, we have compiled all the necessary information to help you make an informed decision. From finding the best business accounting software to exploring options for business budgeting and tax management, this guide has got you covered. Join us as we navigate the world of accounting software, demystifying complex terminologies and providing practical tips along the way. Say goodbye to hours of manual bookkeeping and hello to efficient financial management!

Understanding Your Accounting Needs

Identify your business requirements

When searching for the right accounting software for your business, it is crucial to identify your specific requirements. Consider the nature of your business, the size of your operations, and the specific accounting tasks you need to perform. For example, if you are a small retail business, you may only need basic bookkeeping and inventory management capabilities. On the other hand, if you run a large multinational corporation, you may require more advanced features such as multi-currency support and financial reporting capabilities across multiple subsidiaries. By understanding your unique accounting needs, you can narrow down your options and find a software solution that aligns with your requirements.Consider your budget

Another important factor to consider when choosing accounting software is your budget. Accounting software can vary widely in terms of pricing, with options ranging from free software to high-end enterprise solutions. It’s essential to determine how much you are willing to invest in your accounting software and consider the long-term costs, including any additional fees for extra features or ongoing technical support. By setting a budget, you can focus your search on software options that fall within your price range and avoid any financial strain on your business.Determine the size and complexity of your business

The size and complexity of your business play a significant role in determining the type of accounting software you need. A small business with a few employees and simple financial transactions may be able to manage with a basic accounting software package. However, as your business grows and becomes more complex, you may need software that can handle more extensive financial reporting, inventory management, and tax management. It’s essential to assess the current size of your business and consider its potential growth in the future. This will help ensure that the accounting software you choose can scale with your business and meet your evolving needs over time.Researching Different Accounting Software Options

Look for reputable software providers

When researching accounting software options, it is crucial to start by looking for reputable software providers. These providers have a track record of delivering reliable and high-quality accounting software solutions that are trusted by businesses in various industries. One way to identify reputable providers is to conduct online research and read reviews and testimonials from other customers. Additionally, you can seek recommendations from trusted colleagues or industry experts who have experience with accounting software. By choosing a reputable provider, you can have confidence in the reliability and effectiveness of the software you select.Read customer reviews and ratings

Customer reviews and ratings can provide valuable insights into the strengths and weaknesses of different accounting software options. By reading reviews, you can gain an understanding of the user experience, customer satisfaction, and the software’s overall performance. Look for patterns in the reviews to identify common concerns or standout features that may be relevant to your business. However, it’s important to keep in mind that every business is unique, and what works well for one may not necessarily work for another. Consider the context of the reviews and how they align with your specific requirements and business objectives.Compare features and functionalities

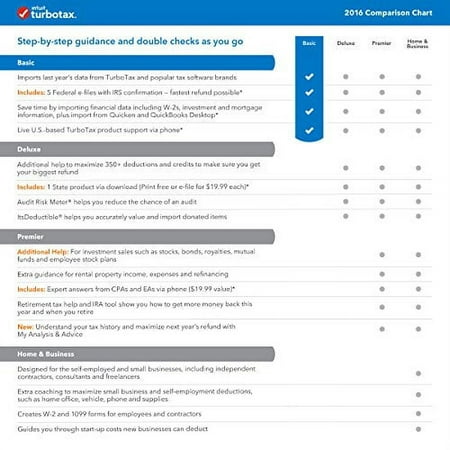

As you research different accounting software options, it’s essential to compare the features and functionalities offered by each. Make a list of the key accounting tasks and features that are important for your business, such as tracking expenses, invoicing, and financial reporting. Then, compare how each software option meets these requirements. Look for features that streamline your workflow, automate repetitive tasks, and provide comprehensive reporting capabilities. Additionally, consider any industry-specific needs or regulatory requirements that your business may have, such as compliance with tax regulations or specific accounting standards.Consider cloud-based versus desktop software

When comparing accounting software options, another important consideration is whether to choose cloud-based or desktop software. Cloud-based software offers the convenience of accessing your accounting data from anywhere with an internet connection, while desktop software is installed and runs locally on your computer. Each option has its advantages and disadvantages, so it’s important to assess which one aligns better with your business requirements. Consider factors such as data security, scalability, collaboration features, and the need for remote access when making this decision.Understanding Accounting Software Terminology

Learn common accounting terms

To effectively navigate and utilize accounting software, it’s important to familiarize yourself with common accounting terms. Understanding the language of accounting will help you interpret financial reports, reconcile transactions, and make informed financial decisions. Some key accounting terms to learn include assets, liabilities, equity, revenue, expenses, debits, credits, and cash flow. Educating yourself on these fundamental concepts will enable you to maximize the benefits of your chosen accounting software.Understand different accounting methods

Different businesses may employ various accounting methods to record and report their financial transactions. Two common methods are the cash basis and accrual basis accounting. The cash basis method recognizes revenue and expenses when cash is received or paid, respectively. In contrast, the accrual basis method records revenue and expenses when they are earned or incurred, regardless of the actual cash flow. Understanding these different accounting methods will help you choose software that aligns best with your preferred method and can handle the recording and reporting requirements accordingly.Familiarize yourself with financial statements

Financial statements are essential documents that provide a snapshot of a company’s financial performance and position. There are three primary financial statements: the balance sheet, income statement, and cash flow statement. The balance sheet shows the company’s assets, liabilities, and equity at a specific point in time. The income statement summarizes the revenues, expenses, and net income or loss over a given period. The cash flow statement details the sources and uses of cash, providing insights into a company’s liquidity. Familiarizing yourself with these financial statements will enable you to interpret the data generated by your accounting software accurately.Essential Features to Look for in Accounting Software

Basic bookkeeping capabilities

At the core of any accounting software is basic bookkeeping functionality. This includes features such as recording and categorizing financial transactions, tracking income and expenses, and maintaining a general ledger. A robust bookkeeping module is essential for accurately managing and organizing your financial data.Invoicing and billing functionalities

Efficient invoicing and billing functionalities are crucial for businesses that rely on timely payments from customers. Look for software that allows you to create professional invoices, customize invoice templates, and track outstanding payments. It should also provide options for online payment processing and automated reminders to help streamline your cash flow management.

Inventory management

For businesses that deal with physical products, inventory management features are vital. Look for software that allows you to track inventory levels, manage purchase orders, and generate reports on stock availability. Additionally, consider features such as serial number tracking, barcode scanning, and integration with e-commerce platforms if they are relevant to your business.Financial reporting and analytics

Comprehensive financial reporting and analytics capabilities are essential for gaining insights into your business’s financial performance. Look for software that offers customizable financial reports, such as profit and loss statements, balance sheets, and cash flow statements. Analytical tools, such as trend analysis and key performance indicators (KPIs), can also help you monitor the health of your business and make data-driven decisions.Bank reconciliation

Bank reconciliation is the process of comparing your accounting records with your bank statements to ensure they match. It’s important to choose software that simplifies this process by automatically importing bank transactions and providing tools to match and reconcile them with your records. This feature can help identify discrepancies, prevent errors, and maintain accurate financial records.Tax management

Tax management features can greatly simplify your tax-related processes, ensuring compliance and accurate reporting. Look for software that supports tax calculations, generates necessary tax forms, and keeps up-to-date with changes in tax laws or rates. It should be able to handle various types of taxes, such as sales tax, VAT, or income tax, depending on your business’s jurisdiction.Integration with other business tools

Consider whether the accounting software integrates with other business tools and platforms that you currently use or plan to use in the future. Integration can streamline your workflows by eliminating the need for manual data entry and ensuring data consistency across different systems. Look for compatibility with customer relationship management (CRM) software, project management tools, e-commerce platforms, and payment gateways.Considerations for Business Budgeting Software

Budget creation and tracking

Efficient budgeting software should allow you to create budgets for different departments or projects and track actual spending against budgeted amounts. Look for features that enable you to set budget limits, allocate expenses, and compare actual results with projected figures. This functionality can help you monitor your financial performance and make informed decisions for resource allocation.Expense tracking and control

Expense tracking is vital for maintaining control over your business’s expenses and ensuring that they align with your budgetary targets. Look for software that allows you to easily record and categorize expenses, track spending by different categories, and generate expense reports. Additionally, features such as receipt scanning or integration with expense management tools can streamline the expense tracking process.Scenario planning and forecasting

Effective budgeting software should offer scenario planning and forecasting capabilities to help you evaluate different business scenarios and their potential financial impact. This feature allows you to create “what-if” scenarios, adjust variables such as revenue or expenses, and analyze the financial outcomes. By exploring different scenarios, you can make informed decisions and develop more accurate financial forecasts.Collaboration and approval workflows

If multiple team members are involved in the budgeting process, look for software that supports collaboration and approval workflows. This functionality allows different stakeholders to contribute to the budgeting process, provide input, and review budget proposals. Streamlining collaboration can result in more accurate budgets and foster better communication and alignment among team members.Exploring Business Tax Software Options

Tax compliance features

Business tax software should offer features that ensure tax compliance with relevant laws and regulations. Look for software that can handle tax calculations, generate the necessary tax forms, and stay updated with changing tax rates or laws. Additionally, consider whether the software supports e-filing capabilities to simplify the submission process.Automated calculations and filings

One of the key advantages of tax software is its ability to automate calculations and filings, saving you time and reducing the risk of errors. Look for software that can calculate different types of taxes based on your business’s financial data. It should generate accurate tax forms and provide guidance on filling them out correctly, making the tax filing process more efficient and error-free.Integration with financial data

For seamless tax management, consider software that integrates with your financial data. This integration eliminates the need for manual data entry and ensures that your tax calculations are based on up-to-date and accurate financial information. Integration also helps maintain consistency between your accounting records and your tax reporting, reducing the risk of discrepancies and improving overall accuracy.

Local tax support and regulations

Depending on the jurisdiction in which your business operates, it’s important to choose tax software that supports the specific local tax requirements. Different regions have varying tax laws, rates, and reporting obligations. Ensure the software you select accommodates the tax regulations relevant to your business, minimizing the risk of non-compliance and potential penalties.Assessing Scalability and Growth Potential

Consider future business growth

When selecting accounting software, it’s essential to consider your business’s future growth potential. Evaluate whether the software can accommodate an increase in the volume of transactions, additional users, or new business locations. Scalable software allows you to smoothly transition as your business expands, saving you the hassle of switching to a different system as your needs change.Evaluate software scalability

Scalability refers to the software’s ability to handle growing data volumes and user requirements without sacrificing performance or functionality. Look for accounting software that can scale with your business, both in terms of performance and capacity. Consider whether the software can handle increased data storage, process larger transaction volumes, and support additional users without experiencing significant slowdowns or limitations.Identify software limitations

While assessing scalability, it’s also crucial to identify any potential limitations or constraints that the software may have. Consider factors such as maximum data storage capacity, transaction processing speeds, number of user licenses, or any technical requirements that may restrict the software’s performance or functionality. Understanding these limitations upfront will help you make an informed decision and avoid any surprises down the line.Ensuring Data Security and Privacy

Data encryption and backup features

Data security is of utmost importance when choosing accounting software. Look for software that offers data encryption measures to protect your sensitive financial information from unauthorized access. Additionally, consider backup features that automatically create copies of your data, ensuring that it can be recovered in the event of a system failure, data corruption, or other unforeseen events.User access controls

To prevent unauthorized access to your accounting system, look for software that provides robust user access controls. These controls allow you to define user roles and permissions, limiting access to sensitive financial data to only authorized individuals. Implementing strong access controls helps protect your business’s financial information and reduces the risk of data breaches.Security audits and certifications

Reputable accounting software providers often undergo security audits and obtain certifications to demonstrate their commitment to data security. Look for software providers that adhere to industry best practices and have certifications such as ISO 27001, which verifies that they have implemented a robust information security management system. These certifications can provide peace of mind that your data is handled securely.Compliance with data protection regulations

Depending on your business’s location, you may be subject to data protection regulations such as the General Data Protection Regulation (GDPR) in the European Union. Ensure that the accounting software you choose complies with the relevant data protection regulations in your jurisdiction. The software provider should have measures in place to protect personal data, such as customer information, and adhere to the necessary legal requirements.Pricing Models and Cost Considerations

Subscription-based pricing

Common pricing models for accounting software include subscription-based pricing. With this model, you pay a recurring fee for access to the software and ongoing support. Subscription pricing often offers flexibility, allowing you to adjust your software usage as your business needs evolve. When considering subscription-based pricing, factor in any potential price increases over time and the total cost of ownership over the software’s lifespan.Free trial and demos

Many accounting software providers offer free trials or demos. Take advantage of these opportunities to test the software’s features, user interface, and usability. It’s important to thoroughly evaluate the software before making a commitment to ensure it meets your business requirements and aligns with your workflow. Consider involving key stakeholders in the trial process to gather different perspectives and ensure buy-in from all parties involved.Additional costs for extra features

Some accounting software providers offer additional features or modules that may incur additional costs. These features can enhance functionality but may come at an extra expense. Evaluate whether these additional features are necessary for your business and whether the benefits outweigh the costs. Be wary of any hidden fees or charges that may not be apparent upfront and carefully review the pricing terms and conditions.Consider long-term costs

When assessing the cost of accounting software, it’s crucial to consider the long-term costs, rather than just the initial investment. Take into account ongoing subscription or licensing fees, additional costs for technical support or software updates, and any potential costs associated with data migration or system integration. By fully understanding the long-term costs, you can make an informed decision that aligns with your budget and financial objectives.Finalizing Your Decision and Implementation

Narrow down your options

After conducting thorough research and considering all the factors outlined above, it’s time to narrow down your options. Create a shortlist of accounting software providers that meet your business requirements, budget, and other criteria identified during your evaluation process. This shortlist will help you focus your efforts on comparing a manageable number of options and making a final decision.Request demos and trials

To gain a deeper understanding of how each software option performs, request demos or trials from the shortlisted providers. During the demos or trials, explore the software’s features, usability, and compatibility with your existing systems. Assess how well the software fits your specific business needs and whether it aligns with your workflow. Take note of any questions or concerns that arise during the demos or trials to address with the software providers.Consider training and support

When implementing new accounting software, it’s essential to consider the training and support provided by the software provider. Evaluate the availability of training resources, such as user guides, tutorials, or online courses, to ensure that your team can effectively learn and utilize the software. Additionally, assess the level of technical support offered, including customer service response times and resolution processes, to address any issues or questions that may arise during software implementation or daily usage.Plan for software implementation

Implementing accounting software requires careful planning to ensure a smooth transition. Create an implementation plan that includes tasks such as data migration, software installation, user training, and system testing. Consider assigning a project manager who will oversee the implementation process and coordinate with all stakeholders involved. It’s important to communicate the implementation plan to your team and set realistic expectations regarding timelines, potential challenges, and the benefits the new software will bring to the organization. By following these steps and thoroughly evaluating different accounting software options, you can find a solution that meets the unique needs of your business. Remember that the right accounting software can streamline your financial processes, enhance decision-making, and contribute to the overall success and growth of your organization.Compare Business Accounting Software and More:

Recent Posts

Recent Comments

Archives

Categories

- A.I. Tools

- Antivirus Software and Security Software

- Business Accounting and Budgeting Software

- Business Books

- Business Courses

- Business Credit Services

- Business Financing

- Business Services

- Business Software

- Digital Marketing Tools & More

- Email Marketing Tools & More

- Human Resources Software

- SAAS Tools

- SEM and SEO Tools & More

- Software and SAAS Deals and Discounts

- Video Creation and Video Marketing Software

![Quicken Classic Deluxe - 1 Year Subscription (Windows/Mac) [Key Card]](https://i5.walmartimages.com/asr/1990436d-2b41-42da-8d9c-c413bcfd4224.488d60bdf61ea67159915cae16825f47.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![Quicken Classic Starter | 1 Year, 1 User | Organize Your Finances | WIN & MAC version [Box]](https://i5.walmartimages.com/asr/5c6a9fdb-b2b2-4f41-b021-ffe541cd0eb8.5a45b82aae66ffce12e97b385908c145.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![H&R Block 2023 Premium & Business Tax Software for 1 User [PC Download]](https://i5.walmartimages.com/asr/9eb51a48-cedb-471b-be26-b1f8cbf3c43f.4956ecef50b5da3bd256c634bbd7526b.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![SAGE 50 PRO ACCOUNTING 2024 U.S. 1-USER 1-YEAR SUBSCRIPTION [Digital Download]](https://i5.walmartimages.com/asr/4fd89965-8cd6-4596-8619-eae568afa91f.1bab83c6ee818325e879483bcff42e2b.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![Quicken Classic Business & Personal - 1 Year Subscription (Windows) [Key Card]](https://i5.walmartimages.com/asr/1324002e-7d1f-4c37-b357-a8976c5618fe.6ff3766ebdffd729f89033853d7a9028.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![Quicken Classic Premier - 1 Year Subscription (Windows/Mac) [Key Card]](https://i5.walmartimages.com/asr/6ef175c8-de95-4ae0-8a53-7e408a20fcc9.dc02be87113c46040dfe97f63085c428.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![SAGE 50 PREMIUM ACCOUNTING 2024 U.S. 1-USER 1-YEAR SUBSCRIPTION [Digital Download]](https://i5.walmartimages.com/asr/b7db8ff1-9ed3-4e22-9851-82d749308e58.681804088560ccade467edfca542e8f8.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![TurboTax Home & Business 2023 Tax Software, Federal & State Tax Return [PC/Mac Download] - BONUS FREE Dr OTC USB Drive 4GB](https://i5.walmartimages.com/asr/b12eecda-2b81-4da9-a373-18bf01fa0afa.f2fbb2b8963acb205d552cd59edca756.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)

![TurboTax Premier 2023 Tax Software, Federal & State Tax Return [PC/Mac Download] - BONUS FREE Dr OTC USB Drive 4GB](https://i5.walmartimages.com/asr/30ec9e5d-d55a-4592-ae91-d6164e08dcde.608ea56b96ed2e3acc47b34232a290e1.jpeg?odnHeight=450&odnWidth=450&odnBg=ffffff)